As 2018 winds down, many of us are turning our attention to end-of-year planning and getting our financial houses in order.

As 2018 winds down, many of us are turning our attention to end-of-year planning and getting our financial houses in order.

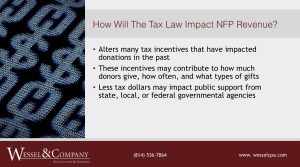

This year brings changes to how charitable giving and nonprofit activity will impact individual tax returns. Most notably, the Tax Cuts and Jobs Act of 2017 nearly doubled the standard deduction allowed for tax filings, and modified qualifications for itemized deductions based on charitable giving. Because filers take only the greater of the two — either itemized or standardized deductions — the combination of changes means some people may not see a tax benefit from their previous levels of giving, if that amount falls short of the standard deduction.

Amy Edmiston is a Certified Nonprofit Accounting Professional with Wessel and Company, and member of CFA’s Audit Committee. Edmiston says the impact of the changes will depend on each individual’s level of giving, but the reasons for giving will stay the same. “If I were to ask you your favorite charity,” she says, “You’ll answer based on what they’re doing and not the tax deduction. In most cases, individuals who have been giving to charities will continue to do so, whether they can deduct it or not.”

Some tax advantages remain, such as benefits for donating stocks and bonds and IRA payouts to nonprofits. There are also strategies emerging to maximize the benefits that have been amended.

Some tax advantages remain, such as benefits for donating stocks and bonds and IRA payouts to nonprofits. There are also strategies emerging to maximize the benefits that have been amended.

Bunching refers to combining multiple years’ worth of giving into one year, so that donations exceed the new, higher, standard deduction. This allows for the same level of charitable giving, distributed over a new time frame. This shift can restore the tax benefit for some givers.

Donor Advised Funds establish a de facto savings account for charitable giving. A donor invests in a nonprofit fund, receiving a tax benefit up front for funds that exceed the standard deduction. That fund can make philanthropic distributions over time in whatever amounts the donor chooses.

The impact to donors will depend on each individual’s level of giving. Small and mid-level donors may choose not to itemize deductions. Tax incentives aren’t driving their donations — those donors are giving because they care about the community and the causes they support.

The impact to donors will depend on each individual’s level of giving. Small and mid-level donors may choose not to itemize deductions. Tax incentives aren’t driving their donations — those donors are giving because they care about the community and the causes they support.

The impact for wealthier donors may be to their advantage. Once they clear the higher threshold for itemizing donations, the new law allows for a greater percentage of gross adjusted income to be claimed as an exemption, which means a larger portion deducted from the filer’s tax bill.

The impact for wealthier donors may be to their advantage. Once they clear the higher threshold for itemizing donations, the new law allows for a greater percentage of gross adjusted income to be claimed as an exemption, which means a larger portion deducted from the filer’s tax bill.

CFA can help you navigate the new landscape. We’ll work closely with you, and your financial advisor if you have one, on a plan tailored specifically to your needs and goals.

There are still infinite ways to make a meaningful difference in your community. Nonprofits face a double-whammy this year, with a reduction in donations compounded by reductions in government support. The opportunity to make a meaningful difference in your community is greater than ever.

There are still infinite ways to make a meaningful difference in your community. Nonprofits face a double-whammy this year, with a reduction in donations compounded by reductions in government support. The opportunity to make a meaningful difference in your community is greater than ever.

“You want to consider donations to charity like an investment in any other company,” Edmiston reminds us. “You invest, buy stocks, with the hopes of generating a profit from that. When you invest in these nonprofits, you’re investing in the great work their doing, so when you invest in these nonprofits you’re really investing in your community.”

CFA has resources to help you do the most with your means, at whatever level you’re comfortable sharing. Starting with the projects and causes you choose to support, all the way through to the structure and distribution of your charitable fund, we’re your partners in philanthropy. To find out more, contact Donor Services Officer Paula Hencel: phencel@cfalleghenies.org / (814) 209-8663. You can also reach out to Amy Edmiston: aedmiston@wesselcpa.com.